Home » Trailer Industry » Trailer Industry News » US Trailer Orders for November

ACT Research: Preliminary Results Show More Than 39k Net Trailer Orders Posted in November

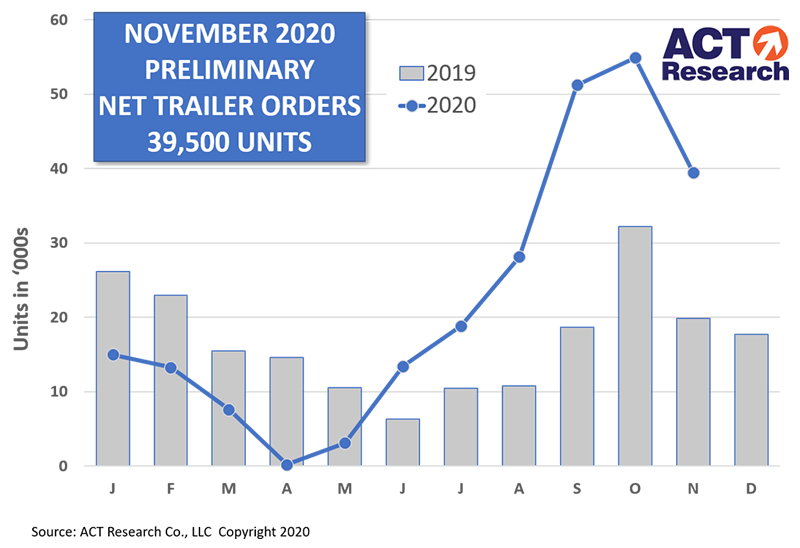

COLUMBUS, IN – (Trailer Technician) – Preliminary information for November indicates that the U.S. trailer industry booked 39,500 net orders for the month. While down 28% from October, November volume was nearly double that seen in the same month last year. The industry has now had six consecutive months with solid year-over-year gains in net orders, and November will likely rank in the industry’s top 10 months. Final volume will be available later this month. This preliminary market estimate should be within +/- 3% of the final order tally.

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers and trailer OEMs and suppliers, to better understand the market.

“While November orders were down sequentially versus October, that matches the order pattern for last year. Remember that October was the third-best net order month in history, so that set up a tough comparison for the industry,” said Frank Maly, Director CV Transportation Analysis and Research at ACT Research. He added, “Dry vans have been the foundation of the recent order surge, and that pattern continued during November. While more than twice the pace of last November, dry van orders appear to be roughly two-thirds of October’s level. Freight rates continue at robust levels, resulting in solid expectations for fleet financials. That means fleets have both the need and ability to invest in equipment.” Maly concluded, “Given concerns regarding availability and timing of production slots in 2021, since existing backlog extends to nearly the end of Q3’21 at current production rates, fleets pulled their order timing forward this year, resulting in the October volume peak.”

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis, and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

ACT’s 64th Seminar is scheduled for February 23-25, 2021. Focused on the continuous evolution and advancement of power and energy changes in the transportation and commercial vehicle markets, OUTLOOK Seminar 64 will feature key industry leaders such as Ryan Reed of Wabash National, John Bennett from Meritor, Lance Riegel of Marvin Johnson, and Dominick Beckman from Hino Motors. Look for more details on this event over the coming months and save the date for February’s event. Click here for seminar information.