Home » Trailer Industry » Trailer Industry News » Trailer Orders Decline in April

FTR Reports U.S. Trailer Net Orders Sharply Decline in April to 10,669 Units

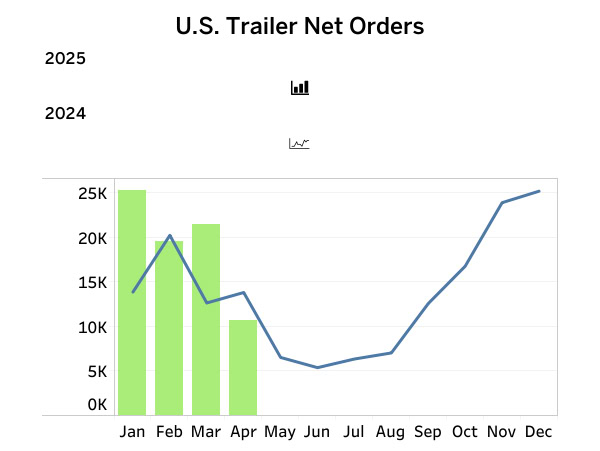

Bloomington, IN – (Trailer Technician) – FTR reports U.S. trailer net orders in April faced significant pressure amid escalating headwinds, including substantial tariff volatility and increasing uncertainty over the economy and the truck freight market. Consequently, net orders sharply declined to just 10,669 units, down 50% month- over-month (m/m) and 23% year-over-year (y/y). This monthly decline surpassed typical seasonal patterns by a wide margin. Even so, U.S. trailer orders exceeded North America Class 8 net orders for a third straight month. Despite April’s sharp drop, year-to-date (YTD) trailer net orders for 2025 totaled 76,901 units, representing a 27% increase compared to the same period last year.

Total trailer build in April decreased 1% m/m and 26% y/y to 17,619 units. 2025 YTD trailer build fell 30% y/y to 63,756 units, an average of 15,939 per month. With total trailer net orders well below production, backlogs decreased by 6,562 units (-5% m/m; -19% y/y) to 120,350 units. The larger m/m decrease in backlogs compared to build lowered the backlog/build ratio to 6.8 months.

Dan Moyer, senior analyst, commercial vehicles, commented, “U.S. tariffs and potential retaliatory measures will significantly impact the U.S. trailer market, raising costs for imported materials and affecting domestic production. OEMs and suppliers can expect higher production costs, reduced margins, and potentially softer demand, prompting some potential shifts toward local sourcing or domestic manufacturing.

“Some fleets may delay new trailer purchases – reflected in the sharp decline in April net orders – and extend equipment lifecycles, boosting aftermarket activity. Rising costs might also encourage limited industry consolidation, creating acquisition opportunities for larger manufacturers. Trailer industry participants that proactively manage supply chain disruptions and pricing pressures may gain a competitive advantage.”

The 2025 FTR Transportation Conference will be held from September 8-11 in Indianapolis with four days of expert-driven insights, trusted forecasts, and actionable strategies that help industry participants anticipate shifts and make smarter decisions. Join hundreds of industry leaders in this opportunity to gain clarity, confidence, and a competitive edge amid ongoing economic uncertainty. Learn more and register at ftrconference.com.

About FTR

For more than 30 years, FTR has served as the industry leader in freight transportation forecasting for the shipping, trucking, rail, intermodal, equipment, and financial communities in North America. FTR’s experts, with over 250 years of combined experience in the transportation industry, provide quantitative analysis with historical and modal-specific insights. FTR’s reports, data, commentary, and insights help clients evaluate market risks, identify new opportunities, and make informed decisions.

FTR is the only company with a complete set of freight data for all modes of transportation with detail at the 3 Digit STCC commodity level. FTR tracks and forecasts 200+ unique commodity groups both quarterly and annually using their proprietary Freight•cast U.S. freight transportation model.

To learn more about FTR visit www.FTRintel.com. Follow us on X @FTRintel and connect with us on LinkedIn!