Home » Trailer Industry » Trailer Industry News » Trailer Orders Weaker Than Expected

FTR Reports U.S. Trailer Net Orders for June Down 17% from May at 4,788 Units

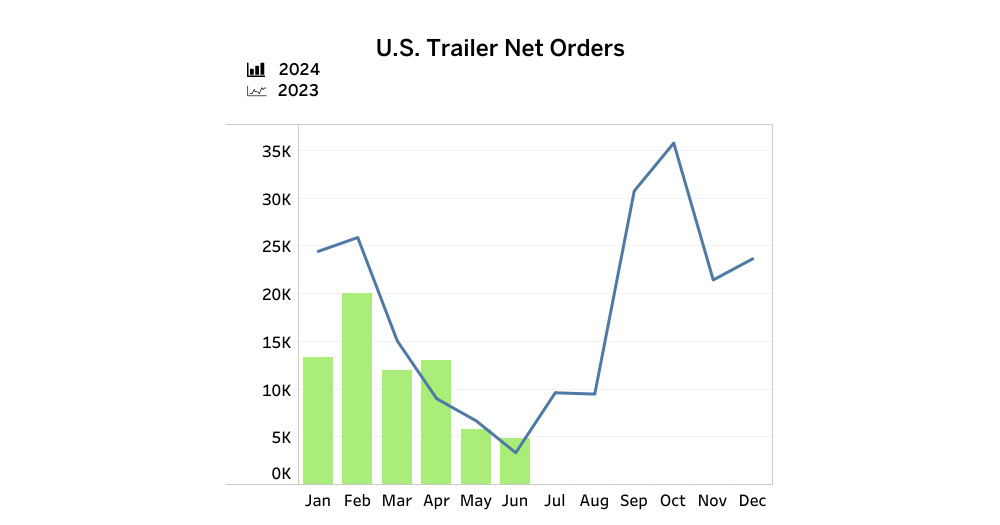

Bloomington, IN – (Trailer Technician) – FTR reports U.S. trailer net orders for June at 4,788 units, down 17% month-over-month (m/m) but up 44% from a June 2023 order level that was the lowest since at least 2013. The number of trailers ordered over the last 12 months now totals 199,600 units.

Orders were weaker than seasonal expectations and 71% below the monthly average order level for the last 12 months. Despite the large year-over-year (y/y) gain, June 2024’s net order total nearly tied May 2020 for the third lowest level in the data. This decrease was driven mainly by a substantial drop in gross orders, although cancellations as a share of gross orders remained above 30%.

Trailer production decreased by 7% m/m and 29% y/y in June, totaling an output of 20,249 units – 21% lower than the average June build level over the past five years.

With net orders coming in substantially below production levels, backlogs in June dropped, falling by 15,526 units to end at slightly more than 113,000 units. The larger m/m decrease in backlogs than in production resulted in a decrease of the backlog-to-build ratio to 5.6 months. This ratio is the second lowest level since 2020 and is slightly below the historical average prior to 2020. The current ratio indicates little overall incentive for trailer manufacturers to adjust production levels.

Dan Moyer, senior analyst, commercial vehicles, commented, “The U.S. trailer market faces significant challenges, primarily due to the stagnant truck freight/rate environment. Additional near-term potential factors may limit the total trailer market’s growth potential/recovery, including high dealer inventory levels, elevated pricing on inventoried units, and falling used trailer values. The opening of 2025 order books later this year along with the beginning of a potential truck freight recovery may improve market conditions. Meanwhile, OEMs will need to manage production cautiously.”

About FTR

For more than 30 years, FTR has served as the industry leader in freight transportation forecasting for the shipping, trucking, rail, intermodal, equipment, and financial communities in North America. FTR’s experts, with over 250 years of combined experience in the transportation industry, provide quantitative analysis with historical and modal-specific insights. FTR’s reports, data, commentary, and insights help clients evaluate market risks, identify new opportunities, and make informed decisions.

FTR is the only company with a complete set of freight data for all modes of transportation with detail at the 3 Digit STCC commodity level. FTR tracks and forecasts 200+ unique commodity groups both quarterly and annually using their proprietary Freight•cast U.S. freight transportation model.

FTR’s Transportation Conference held annually in September in Indianapolis is a unique event bringing together every aspect of the freight transportation world into one place. For more information www.FTRconference.com

To learn more about FTR visit www.FTRintel.com. Follow us on X @FTRintel and connect with us on LinkedIn!