Home » Trailer Industry » Trailer Industry News » Trucking Conditions Index in December Mostly Negative

FTR’s Trucking Conditions Index in December was Broadly Negative Aside from Falling Fuel Costs

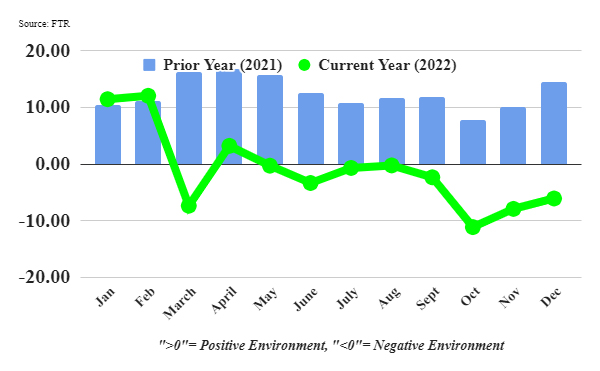

Bloomington, IN – (Trailer Technician) – FTR’s Trucking Conditions Index improved in December to -6.1 from November’s -7.94 reading, but the small gain resulted solely from a sharp drop in diesel prices during the month. Changes in all freight-related TCI components – freight volume, capacity utilization, and freight rates – were unfavorable for carriers in December. The rates component was the most negative it had been since May 2020. The outlook is for mostly similar TCI readings through 2023 with no positive readings expected until late 2024.

Avery Vise, FTR’s vice president of trucking, commented, “Our forecasts indicate continued deterioration in overall market conditions for trucking companies, but uncertainly is still surprisingly high considering that we are nearly three years past the pandemic-induced contraction. Even as record numbers of small for-hire carriers exit the market, payroll job growth in trucking continues to rise, suggesting that overall driver capacity is not falling much – if at all – so far. Although this trend might be reassuring in the near term, it could limit carriers’ margin gains in the next upturn. Freight rates are weakening, but in the contract arena, they look to remain significantly higher than the peak of the last cycle. Carriers’ ability to manage costs always is key to profitability but perhaps never more so than now.”

Details of the December TCI are found in the February 2023 issue of FTR’s Trucking Update, published on January 31. The February edition also includes commentary exploring why the portion of the economy linked to freight transportation remains weak even though Gross Domestic Product continues to see solid increases. Beyond the TCI and additional commentary, the Trucking Update includes data and analysis on load volumes, the capacity environment, rates, and the economy.

The TCI tracks the changes representing five major conditions in the U.S. truck market. These conditions are: freight volumes, freight rates, fleet capacity, fuel prices, and financing costs. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings in either direction suggest significant operating changes are likely.

In addition to the monthly updates on trucking conditions, FTR offers a weekly Trucking Market Update on the State of Freight Podcast. The weekly update, hosted by Avery Vise, covers spot market and economic indicators and major industry developments. Listen to recent episodes and download the accompanying graphics for the latest episode.

About FTR

For more than 30 years, FTR has served as the industry leader in freight transportation forecasting for the shipping, trucking, rail, intermodal, equipment, and financial communities in North America. With over 250 years of combined experience in the transportation industry, FTR experts provide quantitative analysis with historical and modal-specific insights. FTR’s reports, data, commentary, and insights help clients evaluate market risks, identify new opportunities, and make informed decisions.

FTR is the only company with a complete set of freight data for all modes of transportation with detail at the 3 Digit STCC commodity level. FTR tracks and forecasts 200+ unique commodity groups both quarterly and annually using their proprietary Freight•cast U.S. freight transportation model.

To learn more about FTR visit www.FTRintel.com. Follow us on Twitter @FTRintel and connect with us on LinkedIn! To contact FTR, call 888-988-1699 or email info@ftrintel.com.