Home » Trailer Industry » Trailer Industry News » Trailer Orders for March 2021

ACT Research: U.S. Net and New Trailer Orders Gain M/M, Show Triple-Digit Growth Y/Y

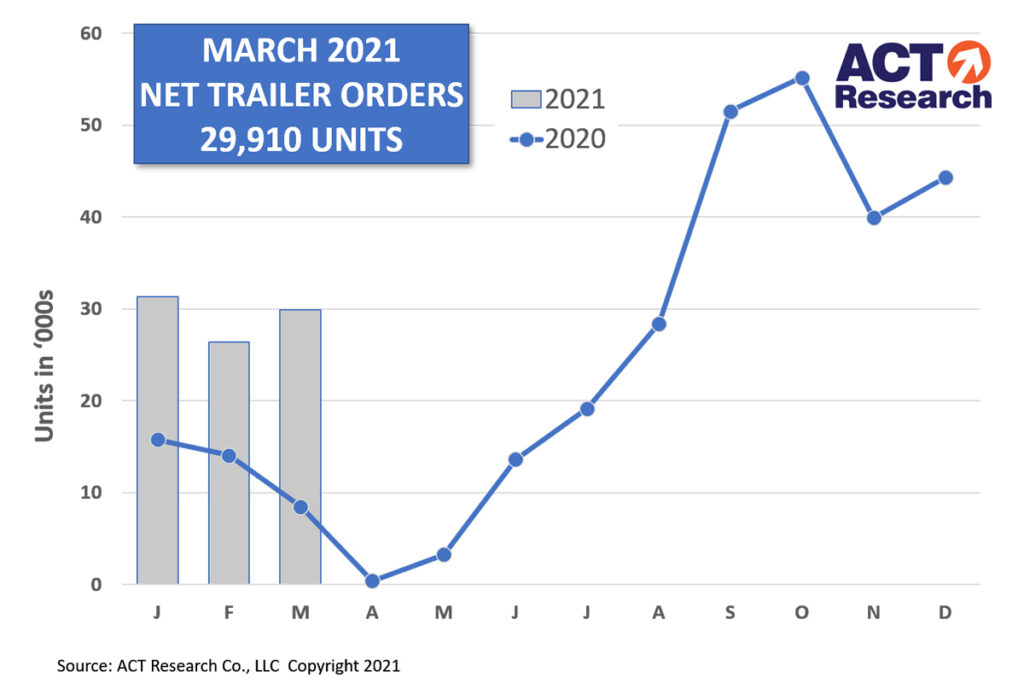

COLUMBUS, IN – (Trailer Technician) – March net US trailer orders of 29,910 units grew more than 13% from the previous month and rose 252%-plus compared to March of 2020. Before accounting for cancellations, new orders of 33.4k units were up 18% versus February and 136% better than the previous March, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers and trailer OEMs and suppliers, to better understand the market.

“After a bit of a pause in February, orders bounced back solidly in March,” said Frank Maly, Director–CV Transportation Analysis and Research at ACT Research. In considering longer-term comparisons, though, he cautioned, “We’re now beginning to enter a period where, because of the unprecedented COVID-related impact in 2020, year-over-year comparisons will become much less valuable in determining the strength of the market.”

Maly added, “While one OEM has publicly stated it is ‘pausing’ order acceptance until the company can better determine longer-term materials costs, others continue to negotiate and book orders.” He concluded, “With many large fleets already on the orderboard, perhaps the next few months will result in a bit more stable order placement, until OEMs generate further production rate improvements.”

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

What’s coming next in 2021 and 2022? ACT’s 65th OUTLOOK Seminar is the planning event for your business needs. Mark your calendar for August 24-26, 2021 to gain market updates and forecasts from ACT’s award-winning, veteran team with more than 200 years of combined industry experience. Click here for more details.

ACT’s commercial electric vehicle study, Charging Forward: 2020-2024 BEV & FCEV Forecast & Analysis, was published in early April, after months of extensive research. Utilizing industry expertise and analysis, as well as the input from a comprehensive list of key industry study participants, ACT Research has developed a critical guide for battery electric and fuel cell electric unit build and sales forecasts over the next two decades. With coverage of Classes 4-8 commercial vehicles, ACT has identified 14 market subsegments and more than 20 application types; this one-of-a-kind report is a must-have for those investing or investigating electric power opportunities. To learn more or to purchase this report, click here.