Home » Trailer Industry » Trailer Industry News » US Trailer Orders (Jan 20 vs Jan 21)

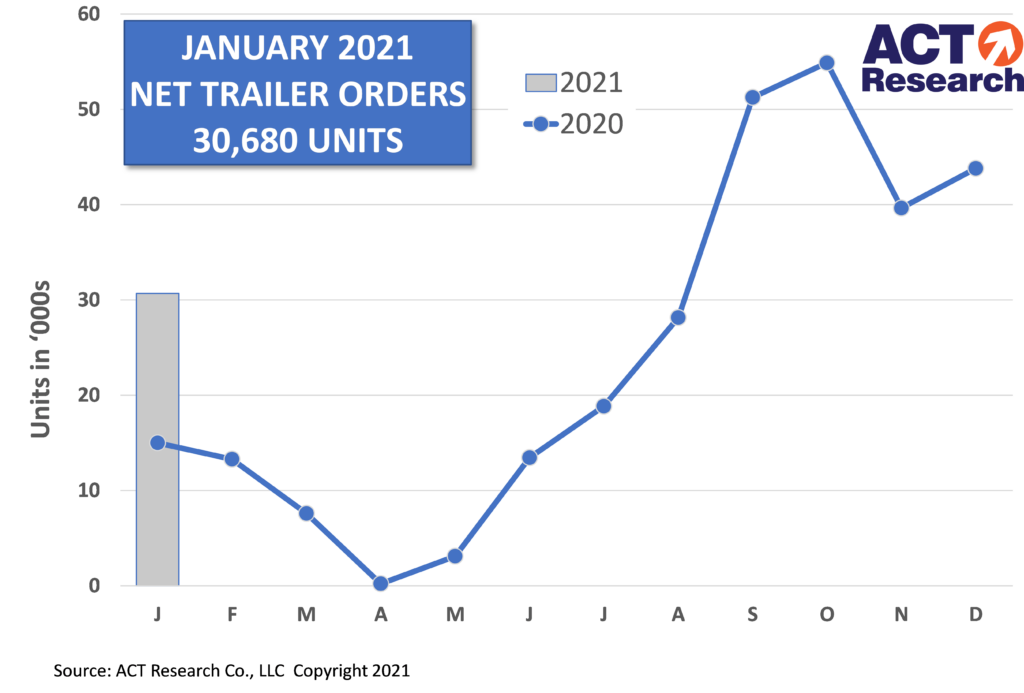

ACT Research: U.S. Trailer Net Orders Open 2021 Significantly Stronger Versus January 2020

COLUMBUS, IN – (Trailer Technician) – January net US trailer orders of 30,680 units fell more than 30% from the previous month, but rose nearly 105% compared to January of 2020. Before accounting for cancellations, new orders of 32.1k units were down 30% versus December, but 91% better than the previous January, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers and trailer OEMs and suppliers, to better understand the market.

“OEMs posted almost 31k net orders in January, down sequentially but still a very solid month,” said Frank Maly, Director–CV Transportation Analysis and Research at ACT Research. He added, “That continued the growth of the orderboard, as orders were 66% above current build rates, and generates a conundrum for OEMs. Open production slots now come with 2022 dates, and OEMs, concerned about component and materials costs, are hesitant to extend pricing commitments that far.”

Maly continued, “Large fleets, driving much of the current demand, may also be hesitant to extend CAPEX plans that far. In the middle, small to medium fleets are struggling to recover from COVID lockdowns.” He concluded, “Expect some order softness until production grows.”

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Frank Maly Profile

Position: Director CV Transportation Analysis & Research

After receiving his B.S. from Bowling Green State University, Frank spent twelve years at a Fortune 150 company where his responsibilities included the North American Industry Forecast as well as other market analysis and market information responsibilities. While there, he also obtained an MBA from Western Michigan University.

Prior to joining ACT in 2011, Frank has been involved in the commercial vehicle industry for 18 years. He’s held analytical and product management roles at a major trailer OEM, a component supplier, as well as a supplier of commercial vehicle analysis and marketing solutions. As a past ACT customer, Frank also contributes a customer-oriented perspective to the organization.