Home » Trailer Industry » Trailer Industry News » US Trailer Orders Up in September

ACT Research: U.S. Trailer Net Orders Post Another Significant Improvement in September

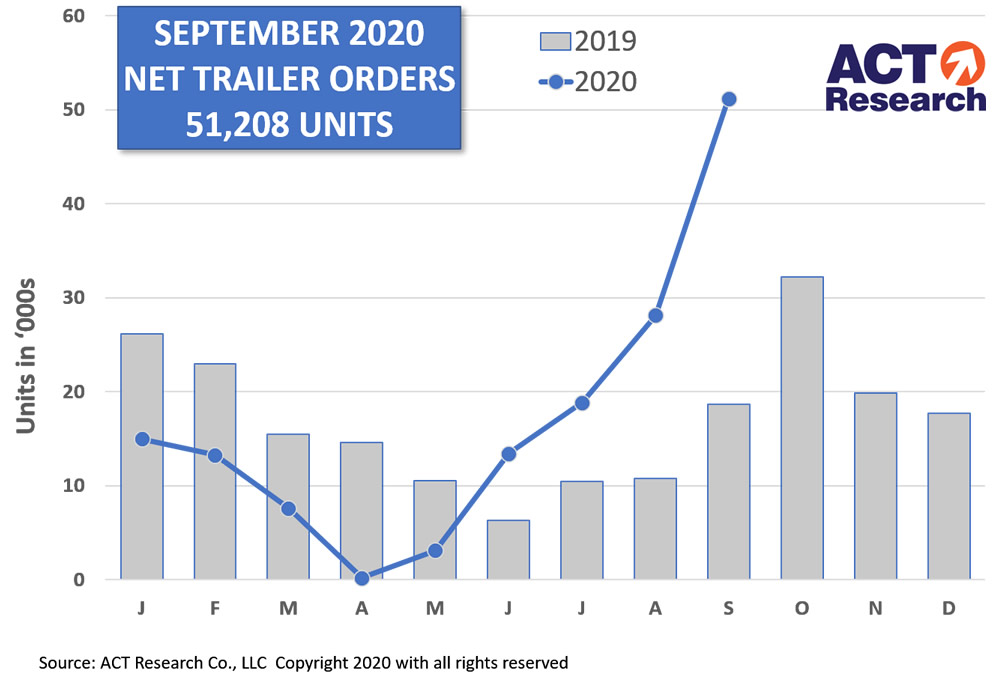

COLUMBUS, IN – (Trailer Technician) – September net US trailer orders of 51,208 units were a significant improvement (up 82%) from August’s uptick and well above September 2019’s level (up 174%). Before accounting for cancellations, new orders of 52k units were up 77% versus August and 140% better year-over-year, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers and trailer OEMs and suppliers, to better understand the market.

“The confluence of several factors is evident in September’s third-highest monthly net volume in history,” said Frank Maly, Director–CV Transportation Analysis and Research at ACT Research. He added, “Pent-up demand is one factor, as we’re now seeing capex release that was curtailed earlier this year by COVID-driven uncertainty. Another factor is lower build rates, pushing fleets to quickly submit their orders, rather than take a chance that new units might not be delivered until well into next year.”

Maly continued, “In addition to fleets, dealers could also be worrying about the timing of stocking orders; conversations have included mention of dealers entering the fray in preparation for next year.” He concluded, “Further solid numbers are likely in the near-term, as the industry enters what has normally been its usual ‘order season’.”

Additionally, ACT Research recently announced plans for a new multi-client study focusing on electrification of the commercial vehicle industry to be released in 2021. The scope of the study will include unit sales for the US and Canada, annually from 2020 to 2030, with single-year outlooks for 2035 and 2040. Class 8 truck and Classes 4-7 truck and bus segments will be considered, with additional segmentation encompassing step vans, conventional and low cab forward trucks, RV, school bus, yard spotter, transit bus categories, as well as the Class 8 straight, day cab, and sleeper subcategories. Our research will compare purchase and operational costs for diesel, battery, fuel cell, and hybrid powertrains in a rigorous comparative total cost of ownership (TCO) framework. It will also take into account concerns, such as infrastructure requirements and costs, regulation, and issues including maintenance, range, durability and vehicle and component replacement. For more details about how to participate in this study, including a full prospectus, contact Ian McGriff at imcgriff@actresearch.net or click here to let us know of your interest.

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

ACT’s 64th Seminar is scheduled for February 23-25, 2021. Focused on the continuous evolution and advancement of power and energy changes in the transportation and commercial vehicle markets, OUTLOOK Seminar 64 will feature key industry leaders such as Ryan Reed of Wabash National, John Bennett from Meritor, Lance Riegel of Marvin Johnson, and Dominick Beckman from Hino Motors. Look for more details on this event over the coming months and save the date for February’s event. Click here for seminar information.

Frank Maly Profile

Position: Director CV Transportation Analysis & Research

After receiving his B.S. from Bowling Green State University, Frank spent twelve years at a Fortune 150 company where his responsibilities included the North American Industry Forecast as well as other market analysis and market information responsibilities. While there, he also obtained an MBA from Western Michigan University.

Prior to joining ACT in 2011, Frank has been involved in the commercial vehicle industry for 18 years. He’s held analytical and product management roles at a major trailer OEM, a component supplier, as well as a supplier of commercial vehicle analysis and marketing solutions. As a past ACT customer, Frank also contributes a customer-oriented perspective to the organization.