Home » Trailer Industry » Trailer Industry News » ACT Research Reports US Trailer Orders Down in January

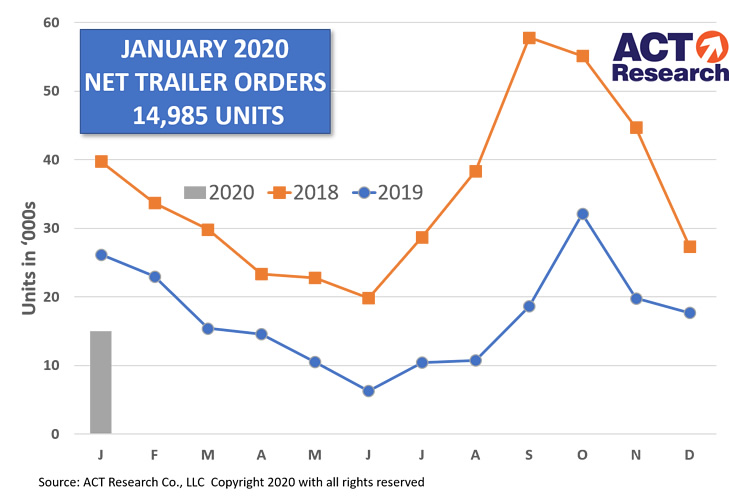

ACT Research: U.S. Trailer Net Orders Opened 2020 Down 15% Sequentially and 28% Y/Y

COLUMBUS, IN – (Trailer Technician) – New US trailer orders of 16.8k were down 9% month-over-month in January, and after accounting for cancellations, net orders of 15.0k dropped 15%. Longer-term comparisons show net orders down 28% year-over-year, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers and trailer OEMs and suppliers, to better understand the market.

“Fleets continued their conservative investment posture in all equipment categories in January,” said Frank Maly, Director–CV Transportation Analysis and Research at ACT Research. He added, “Discussions indicate that the winds of weaker freight volumes and lower rates continue to buffet fleet financial results. They are also seriously questioning their need for additional equipment, as many indicate that capacity constraints dissipated many months ago.”

Maly continued, “An indication of fleet investment retrenchment was heard at the recently completed ACT Seminar #62, where one fleet panel participant indicated that they will not be adding any equipment to their operations this year. That appears to be a common stance of many fleets for 2020.”

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.